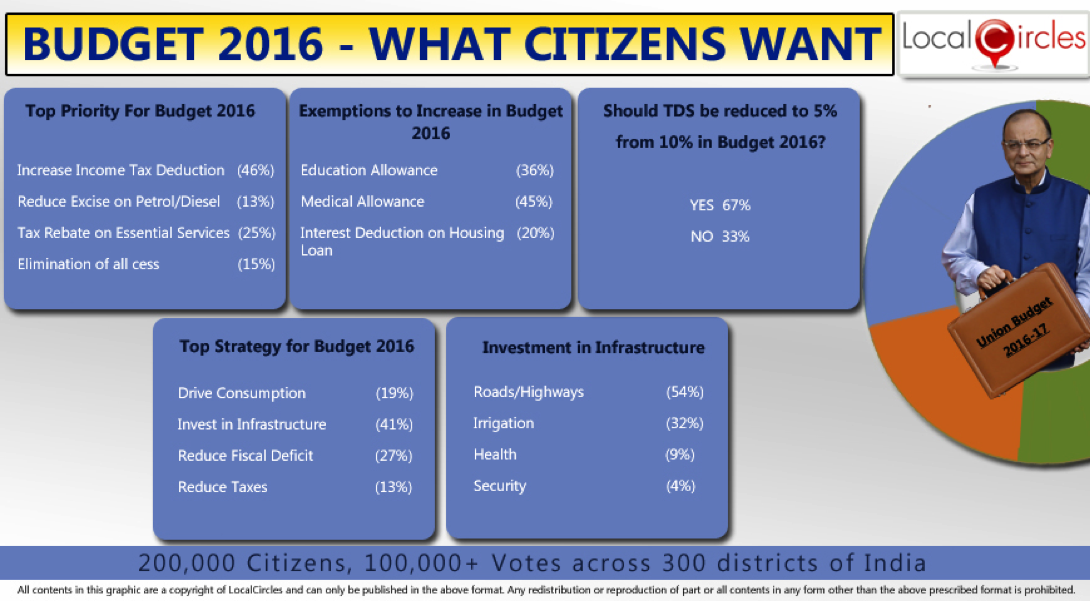

What Citizens Collectively want from India's Union Budget 2016

• Citizens highlight key expectations from Union Budget 2016

o 46% citizens want significant increase in minimum income exemption limit

o 44% of citizens want increase in medical exemption amount

o 68% want TDS rate to be reduced from 10% to 5%

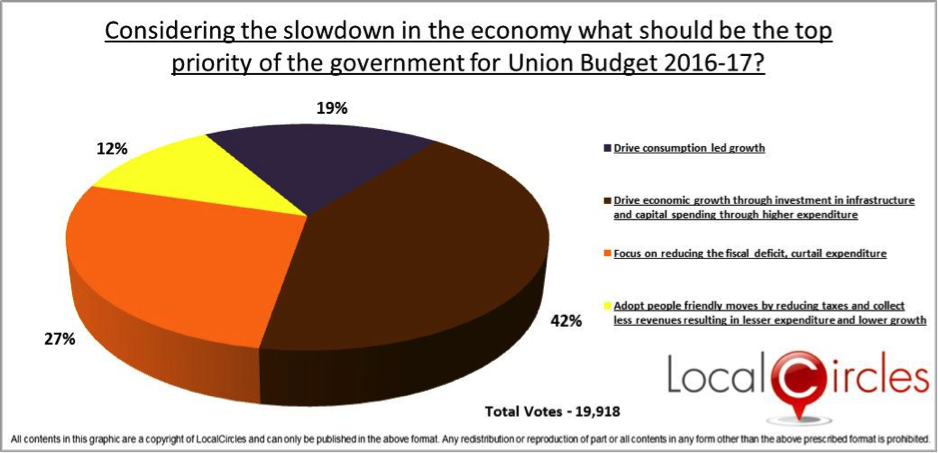

o 42% want Government to drive growth via infrastructure investment

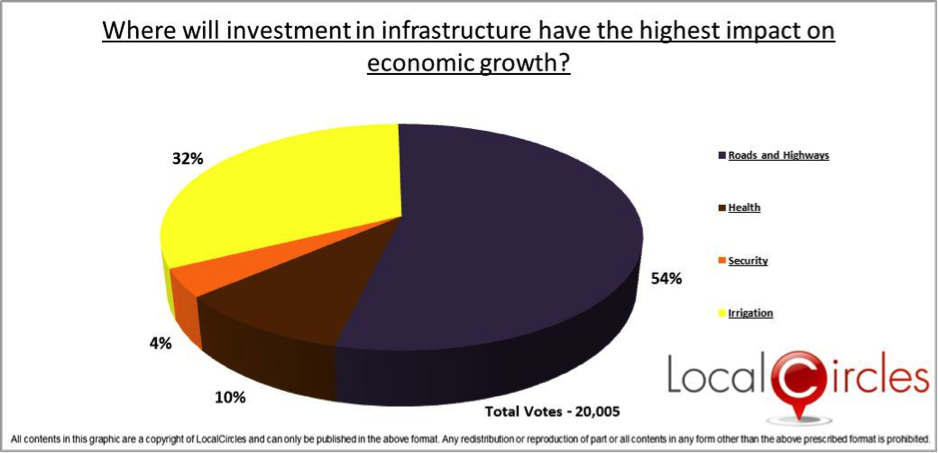

o 54% want Roads and Highways to be the top investment area

• Also highlight how Government can address tax leakages/evasion

February 20, 2016: LocalCircles (www.localcircles.com), India’s largest citizen engagement platform today released the collective citizen inputs for the Union Budget in 2016. Over 200,000 citizens of India participated in this exercise across 300 cities and over 100,000 votes and comments were received across various polls and discussions. In addition to quantitative polls, qualitative discussions were conducted to understand what the common citizen wants from Budget 2016.

Similar to the Rail Budget 2016 citizen consultation exercise where Services and Amenities was the top citizen ask and was incorporated by Ministry of Railways, this exercise has been another example of participative governance and making governance citizen oriented. This report outlines the detailed results of the Citizen Consultation on Budget 2016.

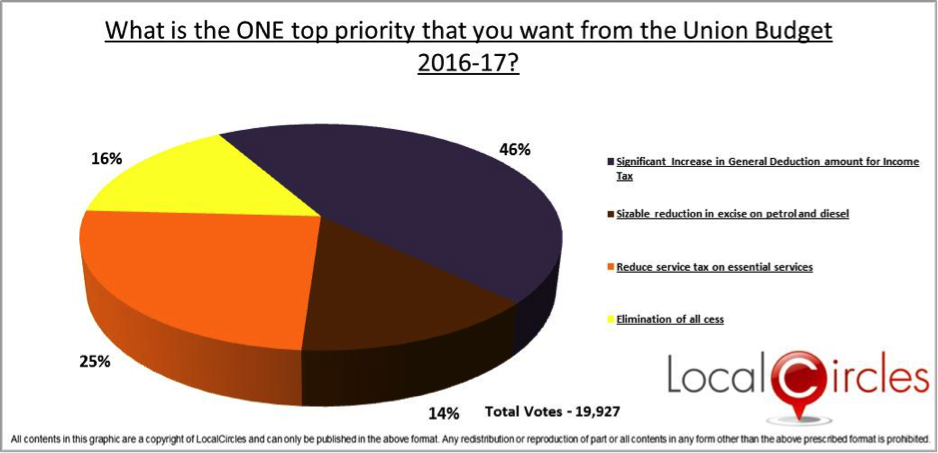

Poll # 1 – Top Taxation Relief Wanted from Budget 2016

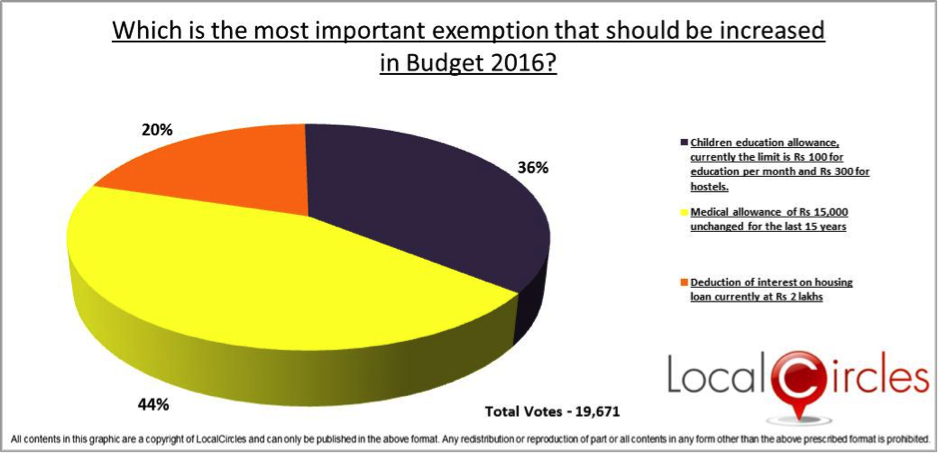

Poll # 2 – Top Exemption Increase Wanted from Budget 2016

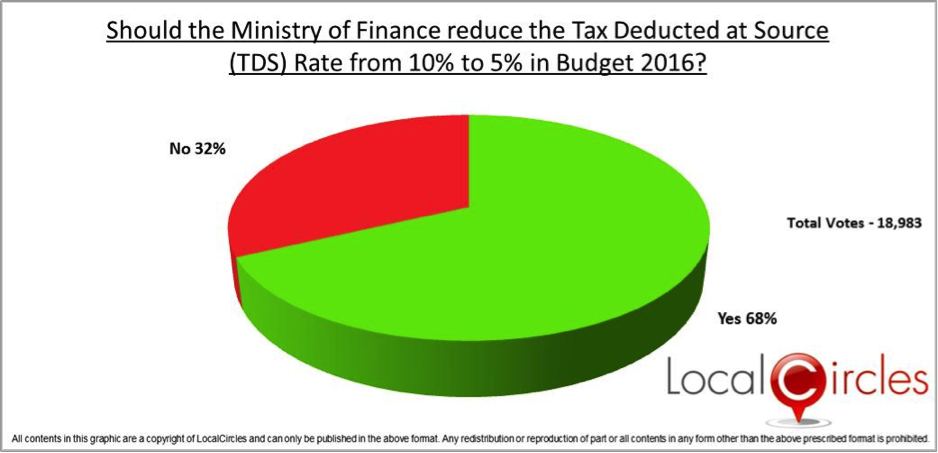

Poll # 3 – TDS rate Reduction from Budget 2016

Poll # 4 – Growth and Fiscal Strategy for Budget 2016

Poll # 5 – Top Investment Sector for Budget 2016

Top Priorities for Budget 2016

- 1. There should be a significant increase in Minimum Exemption/General Deduction Limit upto 5 lakhs a year

- 2. Medical exemption needs to be increased from the 15,000 per year amount

- 3. TDS deduction percentage should be cut to 5%

- 4. Government needs to invest in infrastructure to boost economic growth

- 5. Excise duty on petrol and diesel must be reduced

- 6. Service Tax on essential services must be reduced

- 7. Cess must not be charged till effective deployment model is proven

- 8. Education exemption is unrealistic and must be rationalized

- 9. Deduction amount of interest on housing loan should be re-evaluated

- 10. Investments in Health and Irrigation sectors must be given a priority

- 11. GST must be introduced as early as possible

Secondary Priorities for Budget 2016

- 1. IT exemption limit may be raised to 7.5 lacs for senior citizens

- 2. Extra interest rate for senior citizens reduced recently from 0.55 to 0.25% be increased to 1%

- 3. TDS & service tax should not be deducted from payroll of temporary employees who have no EPF &PRAN numbers

- 4. Provision of no deduction of any tax/cess should be made on tenders accepted at 15% or more below the estimated cost

- 5. Higher incentives should be given for pulses production and export oriented agricultural products

- 6. Minimum interest rate on fixed deposits to be 9% as is proposed for PPF. The interest earned should not be tax

- 7. Tax on pension should be removed or should be applied on amounts of more than 50000

- 8. Deduction under section 80(D) be raised to Rs 50000/ per annum

- 9. Minimum income slabs for ladies should be increased

- 10. The rate of income tax for individuals should be decreased so that more people are encouraged to pay taxes

- 11. The limit of exemption u/s 80C should be increased to Rs 3 lakhs

- 12. Provide house rent deduction to pensioners as is the case with employed people.

- 13. Kerosene subsidy should be eliminated

Citizen Inputs to Government on addressing tax leakage/evasion

- 1. Licenses of Banquets and Caterers asking for cash payment to evade taxes should be cancelled

- 2. Presenting the rent agreement should be made mandatory along with the rent receipts

- 3. The licences of the manufacturers providing false information to evade excise should be cancelled

- 4. Charging but not reporting VAT and service tax should be made a criminal offence

- 5. No cash transactions should be allowed for an amount in excess of Rs.10,000

- 6. E payment facilities like card swipe machines and online fund transfer should be made a mandatory requirement like VAT registration for all businesses

- 7. All payments by wholesalers/retailers should mandatorily be done through cheque, r net banking or credit card only

- 8. Cash on Delivery e-Commerce transactions beyond a certain threshold value should be scrutinized

- 9. All cash withdrawals beyond a pre-defined monthly threshold by individuals and businesses from bank account or ATM must be scrutinized

- 10. All scrap buying and selling by businesses must be done electronically

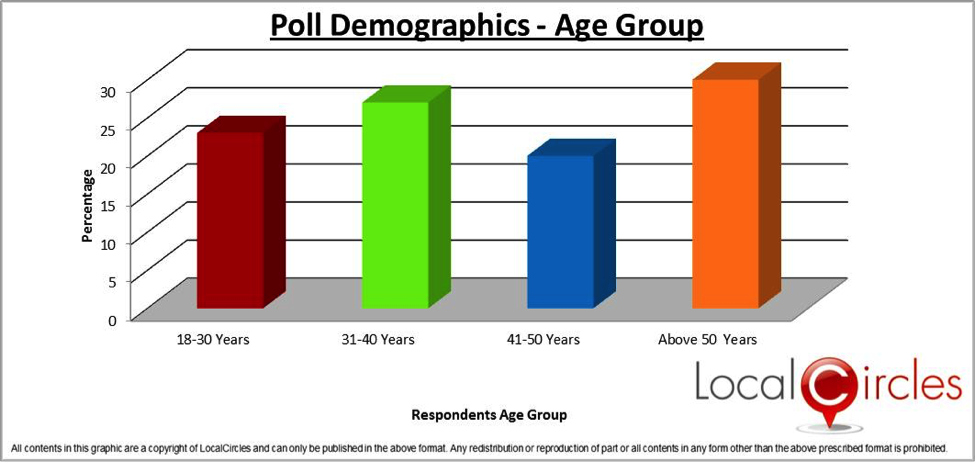

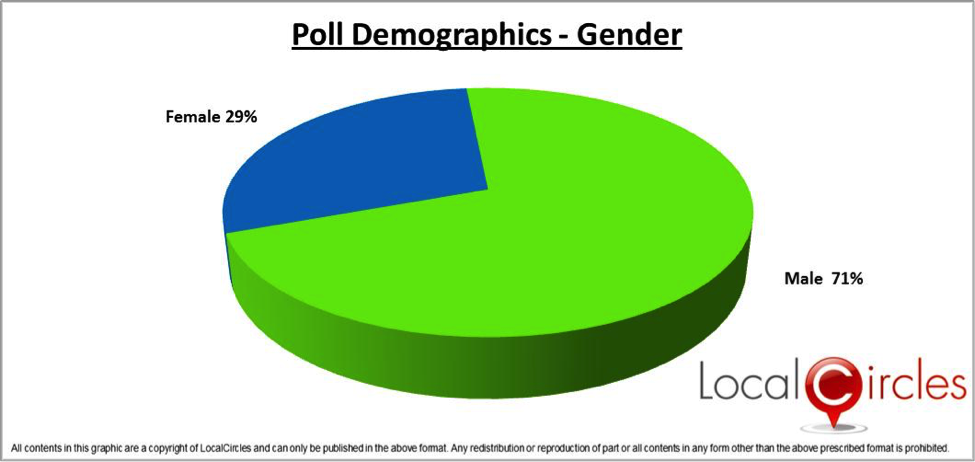

Budget Poll Demographics

Average Number of Respondents per Poll : 19,596 Total Number of Unique Respondents on Five Polls : 42,220 Total number of districts to which respondents belong : 309

Demographics of Unique Respondents

Poll Demographics: Age Group

Poll Demographics: Gender

About LocalCircles

LocalCircles is India’s leading citizen engagement platform that connects citizens at local, city and national level to participate in governance and make their urban life better. LocalCircles has more than 1,000,000 citizens connected on it across the country. All data and poll results are an exclusive copyright of LocalCircles so please give due credit.