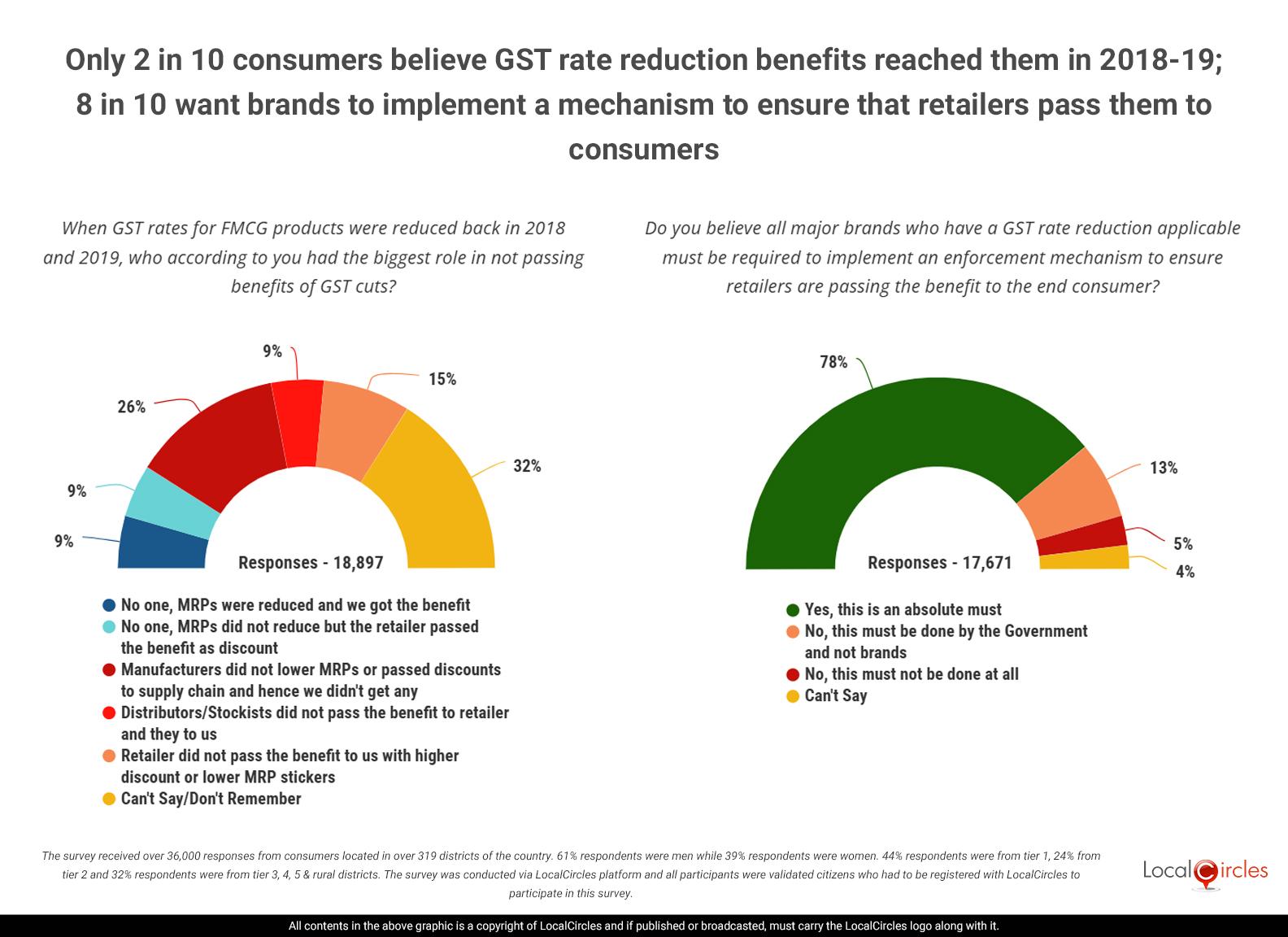

Only 2 in 10 consumers believe GST rate reduction benefits reached them in 2018-19; 8 in 10 want brands to implement a mechanism to ensure that retailers pass them to consumers

September 19, 2025, New Delhi: Even as consumers are deferring purchase of big-ticket products like television, washing machines, etc., till the new Goods and Service Tax (GST) rates come into effect, the central government has asked businesses to provide tentative price lists of consumer durables and other products to see the exact relief consumers will receive. The list is proposed to be displayed on the official GST website ahead of the September 22 deadline.

Businesses have also been asked to display both pre- and post-GST rates at their retail outlets or dealerships so that consumers can know the exact relief they are getting. The Central Board of Indirect Taxes and Customs (CBIC) has had a meeting with representatives from business chambers, industry bodies, and ministries of heavy industry, consumer durables, agriculture, and pharma to ensure smooth implementation of the rate cut announced by the GST Council. The central government expects 90% of the rate rationalization to be passed on to customers, with most industries agreeing to pass on the benefits of the rate cuts. This may result in reduction of costs by 10% for consumer durables and 12-15% for automobiles, including two-wheelers. Industry bodies are aware that only if a price difference is noticed will the consumers be willing to make big purchases.

The National Pharmaceutical Pricing Authority has, meanwhile, asked pharmaceutical companies and medical device makers to pass on the benefit of reduced GST rates to consumers with effect from September 22. "The benefit of reduction in GST rates shall be passed on to consumers/patients effective from September 22, 2025. All the manufacturers /marketing companies selling drugs/formulations shall revise the prices of drugs/formulations (including medical devices) accordingly, with effect from September 22," the authority said in an order. The 56th GST Council has recommended slashing of GST rates on major drugs from 5% to nil. The medications earlier charged under 12% slab are now being shifted to 5% per cent slab.

The Department of Legal Metrology under the Ministry of Consumer Affairs has given relief to manufacturers where old packaging with old MRP labels can continue to be used till March 31, 2026 sparing firms from re-labeling and re-packaging after GST rate cuts. While such a move helps the manufacturers in exhausting old stocks, it reduces the chances of consumers getting the full rate reduction benefits with full dependency on retailer passing the rate reduction benefits. In 2018-19, most consumers expressed not seeing these benefits despite the GST rate reductions.

As the transition date approaches, LocalCircles has attempted to capture the experience of consumers from the 2018-19 rate cuts as well as attempted to understand what according to them should brands be doing to ensure the end consumer gets the rate reduction benefit come Sep 22nd. The new survey received over 36,000 responses from consumers located in over 319 districts of the country. 61% respondents were men while 39% respondents were women. 44% of respondents were from tier 1, 24% from tier 2 and 32% respondents were from tier 3, 4, 5 & rural districts.

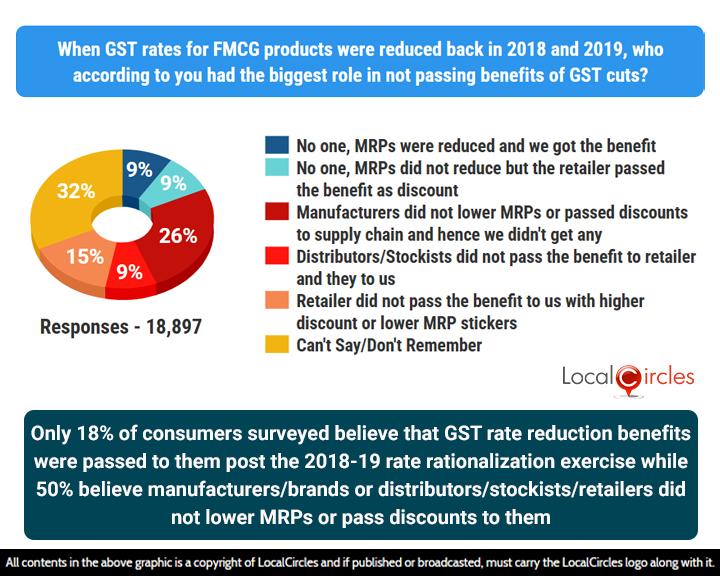

Only 18% of consumers surveyed believe that GST rate reduction benefits were passed to them post the 2018-19 rate rationalization exercise while 50% believe manufacturers/brands or distributors/stockists/retailers did not lower MRPs or pass discounts to them

The last big change in GST rates was in 2018 and 2019. The survey asked consumers, “When GST rates for FMCG products were reduced back in 2018 and 2019, who according to you had the biggest role in not passing benefits of GST cuts?” Out of 18,897 consumers who responded to the question 9% indicated “no one, MRPs were reduced and we got the benefit”; 9% of respondents indicated “no one, MRPs did not reduce but the retailer passed the benefit as discount”; 26% of respondents indicated that the “manufacturers did not lower MRPs or passed discounts to supply chain and hence we didn’t get any”; 9% of respondents indicated that the “distributors/ stockists did not pass the benefit to retailers and they to us”; 15% of respondents indicated that the ”retailer did not pass the benefit to use with higher discount or lower MRP stickers” and 32% of respondents did not give a clear answer. To sum up, only 18% of consumers surveyed believe that GST rate reduction benefits were passed to them post the 2018-19 rate rationalization exercise while 50% believe manufacturers/brands or their retailers did not lower MRPs or pass the discounts through the end retailer to them.

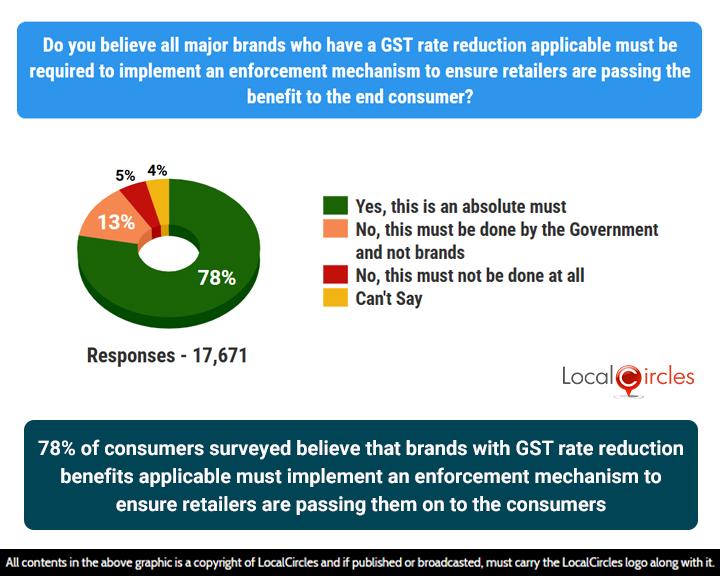

78% of consumers surveyed believe that brands with GST rate reduction benefits applicable must implement an enforcement mechanism to ensure retailers are passing them on to the consumers

Given the experience of consumers in the past, the survey asked, “Do you believe all major brands who have GST rate reduction applicable must be required to implement an enforcement mechanism to ensure retailers are passing the benefit to the end consumer?” Out of 17,671 consumers who responded to the question 78% indicated “yes, this is an absolute must”; 13% of respondents indicated “no, this must be done by the government and not brands”; 5% of respondents indicated “no, this must not be done at all”; and 4% of respondents did not give a clear answer. To sum up, 78% of consumers surveyed believe that brands with GST rate reduction benefits applicable must implement an enforcement mechanism to ensure retailers are passing them on to the consumers.

In summary, experience shows that consumers do not necessarily get the benefits of GST rate change. The study has revealed that post 2018-19 GST rate rationalization only 18% consumers surveyed believe that the benefits were passed to them post. However, 50% believe manufacturers/brands did not lower MRPs or distributors/stockists/retailers did not pass discounts to them. Given the experience in the past, 78% of consumers surveyed believe that brands with GST rate reduction benefits applicable must implement an enforcement mechanism to ensure retailers are passing them on to the consumers. Given that the anti-profiteering authority is no longer in existence and no mandate has been issued under the Consumer Protection Act 2019 to classify not passing benefits as unfair trade practice, the reliance literally is on brands now to ensure the reduced rates are passed by the retailers to the end consumers.

Survey Demographics

The survey received over 36,000 responses from consumers located in over 319 districts of the country. 61% respondents were men while 39% respondents were women. 44% of respondents were from tier 1, 24% from tier 2 and 32% respondents were from tier 3, 4, 5 & rural districts. The survey was conducted via LocalCircles platform, and all participants were validated citizens who had to be registered with LocalCircles to participate in this survey.

About LocalCircles

LocalCircles, India’s leading Community Social Media platform enables citizens and small businesses to escalate issues for policy and enforcement interventions and enables Government to make policies that are citizen and small business centric. LocalCircles is also India’s # 1 pollster on issues of governance, public and consumer interest. More about LocalCircles can be found on https://www.localcircles.com

For more queries - media@localcircles.com, +91-8585909866

All content in this report is a copyright of LocalCircles. Any reproduction or redistribution of the graphics or the data therein requires the LocalCircles logo to be carried along with it. In case any violation is observed LocalCircles reserves the right to take legal action.