1 year on, businesses still have challenges with filing GST returns and getting queries answered

02nd July 2018, New Delhi: GST came into effect on 1st July 2017 and it has since been 1 year of ups and downs. In this time many decisions were taken by the GST Council to ease the pressure that was created, including lowering tax slabs, extensions for filing GST returns and much more. LocalCircles conducted a detailed survey to understand business and citizen perception of what is actually happening out there. The survey comprised of 4 polls and received more than 13,000 responses.

The first question asked how has the GST Helpdesk (phone, online or email) responded to their queries in general. 31% said they received timely responses, 24% said they received acknowledgements but no responses, while 45% said they did not receive any response.

69% businesses say they did not receive a response on their query from the GST helpdesk

The government had set up GST helplines to help various traders, businessmen, manufacturers and suppliers cope up with the confusion around GST implementation. The GSTN helpdesk and the CBIC Mitra Helpdesk have been contracted for a period of five years and seven years respectively.

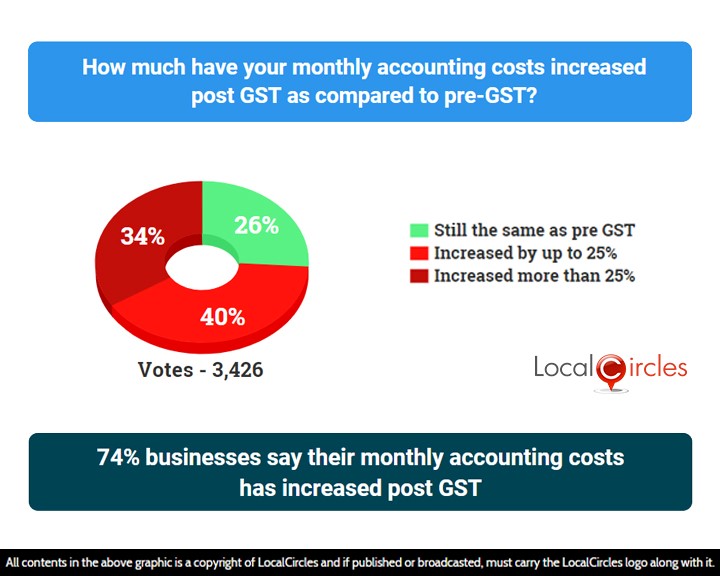

The results of the second poll showed that for 40% businesses the monthly accounting costs have increased by up to 25% while for 34%, it has increased by more than 25%. 26% businesses said that it is still the same as pre-GST.

74% businesses say their monthly accounting costs has increased post GST

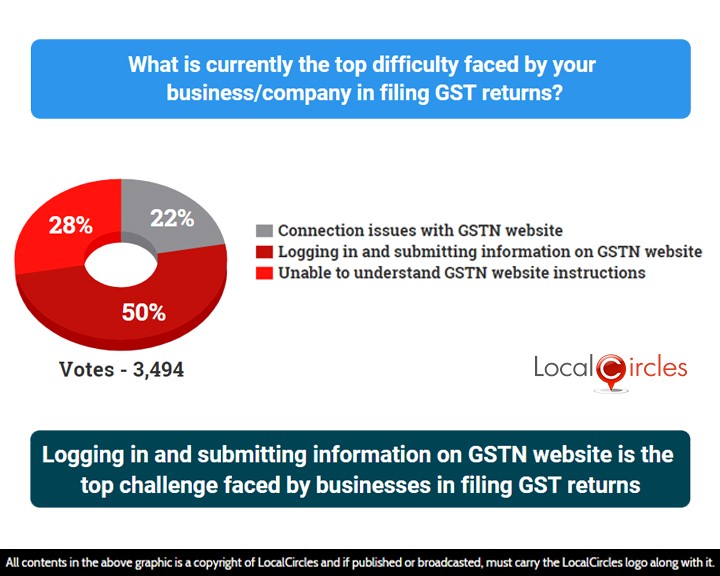

The next question asked citizens what is the biggest difficulty being faced by them in filing GST returns. 50% said logging and submitting information on GSTN website was the main issue while 22% said internet and connection issues with GSTN website bothered them the most. 28% said they were unable to understand the GSTN site information which was creating problems for them.

Logging in and submitting information on GSTN website is the top challenge faced by businesses in filing GST returns

The last question asked startups, SMEs, service providers or business heads how much time they were spending on GST compliance. 29% said they were spending same time as before on GST compliance while 21% said they were spending marginally more time. 50% said they were spending a significant amount of their time on GST compliance.

Most businesses have spent more time on tax compliance in the GST regime

Though the intention of GST was to simplify tax regime, issues like double taxation, misplaced transitional provisions, credit blockages, uncertainty on reversal of credit etc. made the implementation of GST tougher.

Many startups and SMEs had also reported on LocalCircles that the GSTR filing process is lengthy and time consuming due to which they are not able to give enough time towards running their businesses well and are suffering losses.

You may also like:

- • 1 year of GST: Consumers see limited benefits from GST, want better enforcement: LocalCircles Survey

- • 250 days of GST: Consumers say not enough benefits flowing their way

LocalCircles, India’s leading Community Social Media platform takes Social Media to the next level and makes it about Communities, Governance and Utility. It enables citizens to connect with communities for most aspects of urban daily life like Neighborhood, Constituency, City, Government, Causes, Interests and Needs, seek information/assistance when needed, come together for various initiatives and improve their urban daily life. LocalCircles is free for citizens and always will be!

K Yatish Rajawat- media@localcircles.com

All content in the above graphics in this report are a copyright of LocalCircles and must be used only in the prescribed format. LocalCircles reserves the right to take legal action against any reproduction or redistribution of this content without explicit written approval of LocalCircles.

Enter your email & mobile number and we will send you the instructions.

Note - The email can sometime gets delivered to the spam folder, so the instruction will be send to your mobile as well